Many people consider gold as a hedge against market volatility, political and economic uncertainties, and local currencies weakening. But what about stocks? Is that really true that gold goes up when stocks go down?

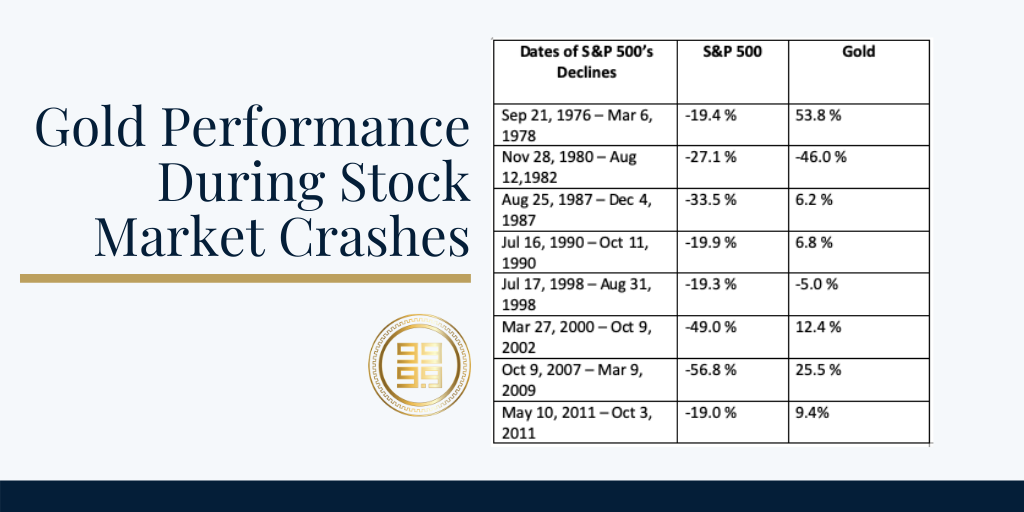

To answer the question above, there is a need to have a look at some historical data. First, let’s look at past stock market crashes and gold’s performance to distinguish tendencies. The table shows the largest S&P 500 declines since 1976, and gold prices responses to each.

According to historical data, we may estimate that in most cases, the price of gold goes up when stocks go down.

Historically, the value of commodities and equities has been inversely related. Economy bases on the fiat currency, meaning that it is worth the value of the actual printed paper. The stock market is a reflection of dollars at work to determine how people value their nation’s businesses and corporations. When the country continues to struggle through the recession and the dollar begins to weaken – the stock market declines. As a result, a market traditionally re-allocates from perceived riskier assets (such as equities during a downturn) to assets that have tangible value, such as commodities. That’s because it makes investors look for something else to trust. This way, they turn to gold.

Gold as a True Standard

Gold is recognized as the true standard of value across the globe. It is a standard for worldwide exchange and has been since the dawn of time. Gold maintains its value from country to country and is not subject to the same systematic risk the stock market is. So, when investors experience a market decline, stocks and the dollar moves downward. Thus, they become less desirable. Gold then becomes more wanted, and according to the law of supply and demand, its value increases as well. That’s how the formula “gold goes up when stocks go down” works.