What would you do if your country’s economy crashed, your currency lost its value, and interest rates were soaring? In such a case, gold is one of the only assets which might protect you. Gold is a global standard, and any investor can buy and sell it anywhere across the world. Gold has investors’ backs when all other asset classes leave them high and dry. Therefore, for every investor’s portfolio, gold is the best of all commodities.

Here are the reasons why:

🔸 Proven Reputation Throughout History

Unlike stocks, gold has never gone to zero. Since the emergence of gold coins in around 800 BC, people have always recognized the value of gold was and continued to hold it for different reasons. Unlike fiat currency and other commodities, gold has kept its value for centuries, making it an attractive option for investors. People have seen gold as a way to preserve and pass on their wealth from generation to generation.

🔸 Inflation Hedge & Deflation Protection

Gold has always been a hedge against inflation since gold prices tend to rise while the stock market falls during high-inflation times. Why? Many investors decide to buy gold and protect their wealth against value exhaustion, which comes from an increase in fiat prices. Since gold is dollar-denominated, any weakness in the dollar pushes up gold prices and vice versa. So, when the USD value strengthens, gold bought with foreign currencies becomes more expensive. It can reduce the amount of gold purchased internationally. Thus, lower demand will put downward pressure on gold prices.

🔸 Limited Supply

Since the 1990s, much of the gold supply in the market has come from sales of gold bullion from the global central banks’ vaults. This process slowed down only in 2008. At the same time, new gold production from mines has declined since 2000. As a general rule, a reduction in the supply increases gold prices.

🔸 Portfolio Diversification

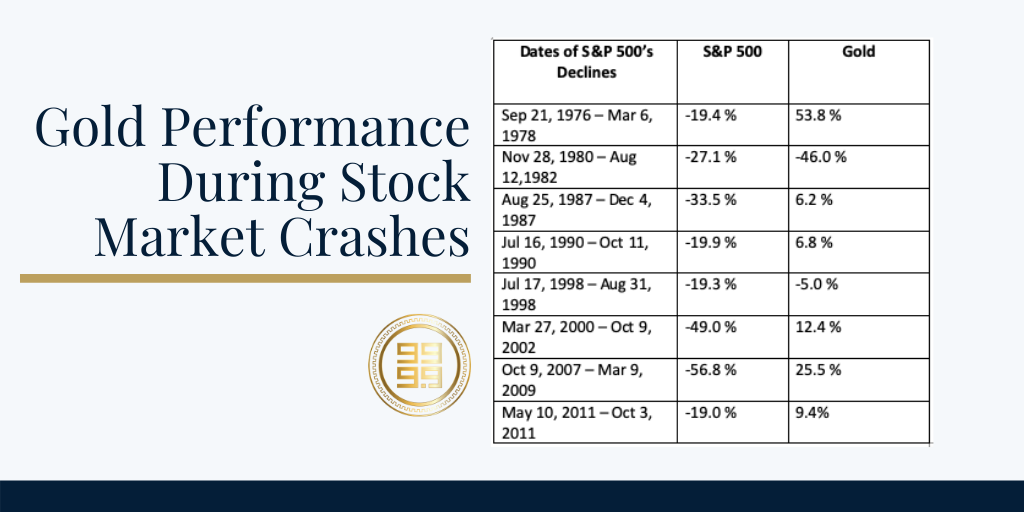

The secret to successful diversification is to find investments that are not closely correlated. Historically, gold has had a negative correlation to stocks and other financial tools. First, let’s look at previous stock market crashes and gold’s performance to see tendencies. The table below shows the correlation between the largest S&P 500 declines and gold prices in the following years.

All in all, when you look at the bigger picture, gold does well when stock markets are turbulent. It also offers a reliable alternative when other commodities are underperforming. This reliability is why gold ETFs saw a $1.9 billion net inflow of investor money in October after the turbulence of August and September. Thus, wise investors choose gold combined with other different commodities in a portfolio to reduce the overall volatility and risk.